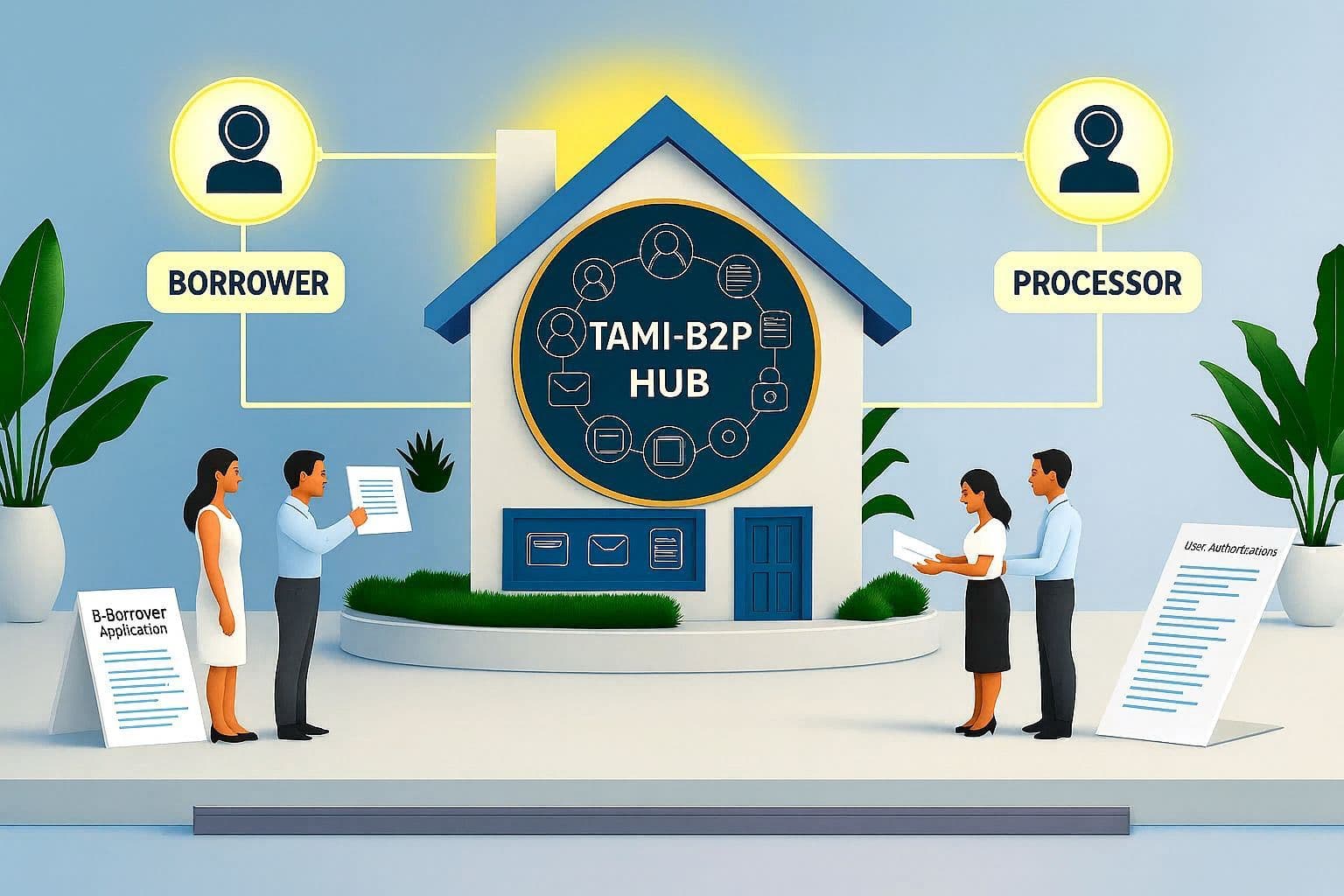

TAMIB2PHubThe Borrower-to-Processor Platform

TAMIB2PHubThe Borrower-to-Processor Platform

A Unified POS + LP Experience.

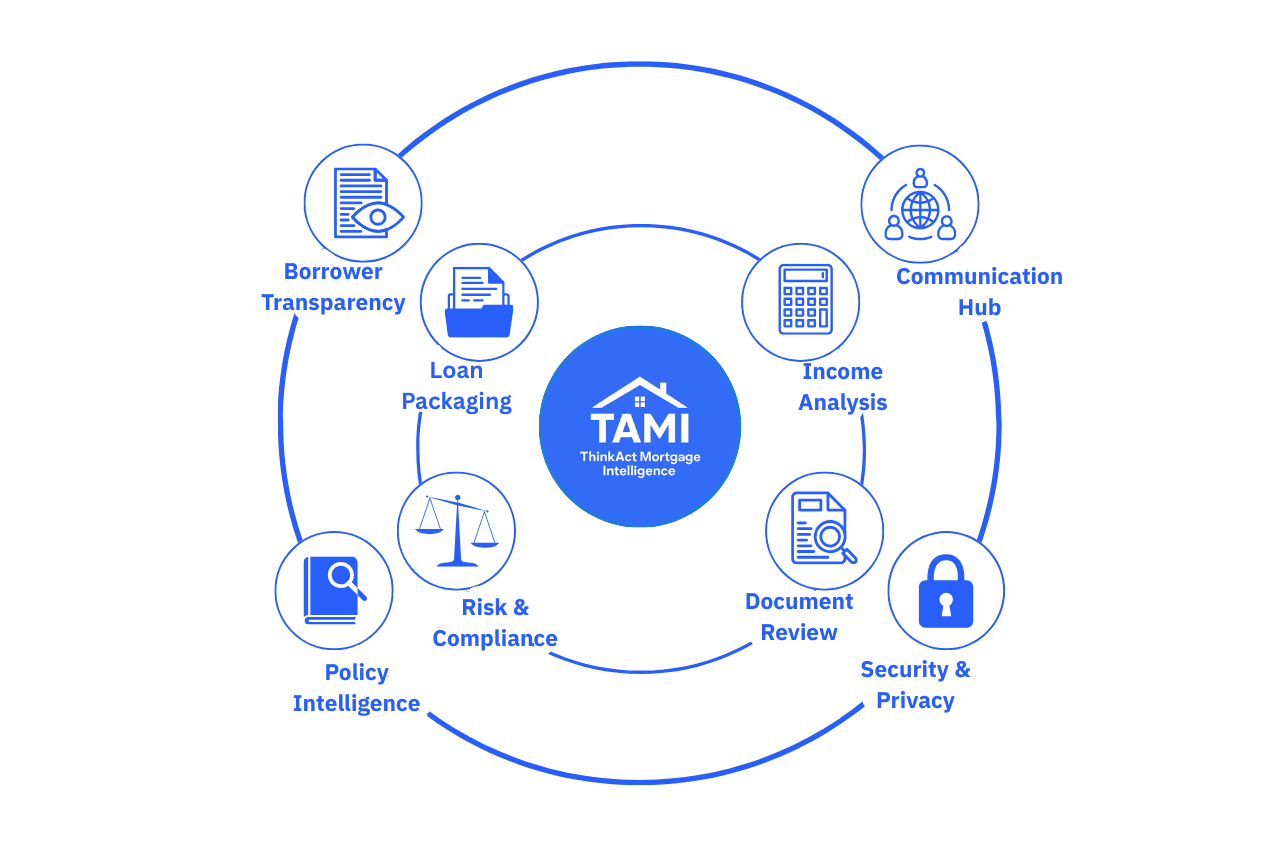

B2P Hub Platform Features

Comprehensive AI-powered tools for seamless mortgage processing

Intelligent Document Review

Why It Matters:

Manual review leads to errors and late discovery of missing docs.

TAMI Delivers:

- Auto-verification, extraction & classification

- Risk/highlight insights

- Zero manual entry

Borrower Transparency

Why It Matters:

Borrowers want clarity, not guesswork.

TAMI Delivers:

- Dynamic eligibility as docs upload

- Real-time status updates

- Instant alerts for required actions

Communication Hub

Why It Matters:

Scattered communication slows decisions.

TAMI Delivers:

- In-file secure messaging

- AI email agent for follow-ups and doc requests

- Central notes dashboard

Business Income Analysis

Why It Matters:

Manual calculations slow everything down.

TAMI Delivers:

- Automated income analysis for all entity types

- Year-by-year cash-flow breakdown

- Bank statement analytics & Fannie Mae compliance

Risk & Compliance

Why It Matters:

Late risk detection is costly.

TAMI Delivers:

- Real-time credit & compliance alerts

- Continuous eligibility checks

- 24/7 monitoring

Security & Privacy

Why It Matters:

Mortgage data is highly sensitive.

TAMI Delivers:

- Role-based access

- End-to-end encryption

- Complete audit trails

Loan Packaging

Why It Matters:

Manual packaging causes errors and multiple revision cycles.

TAMI Delivers:

- Auto-generated disclosures & loan documents

- Real-time compliance checks

- Pre-underwriting validation

Policy Intelligence

Why It Matters:

Searching policy manuals wastes time.

TAMI Delivers:

- Instant Fannie Mae policy answers

- Context-aware guidance

- Real-time interpretation

TAMI-POS

TAMI-POS

The AI POS Agent That Completes Applications For You

Upload OR Email Your Documents your documents — TAMI does the rest with intelligent automation and a built-in guided assistant.

TAMI-POS in Action

Smart Assistant

Guided 1003 Filing — Auto-Filled, Multilingual, Effortless.

TAMI's guided assistant walks borrowers through every step with clear explanations, multilingual support, and instant auto-fill validation—delivering a faster, more accurate application.

Intelligent Guided Assistant

Real-time guidance through every 1003 section—improving accuracy and reducing back-and-forth with processors.

Multilingual Support

Spanish, Arabic , Hindi, and more—borrowers complete the application in the language they're most comfortable with.

Auto-Fill & Validation

TAMI auto-extracts data from uploaded documents to prefill and validate fields instantly, lowering errors and avoiding conditions.

AI Identifies Every Document Type

TAMI automatically recognizes W-2s, 1040s, 1065s, paystubs, bank statements, and dozens of other borrower and business documents with high precision, using advanced OCR and intelligent document processing (IDP). Built to support borrowers, sole proprietors, and multi-entity corporate structures, TAMI handles even the most complex files.

Smart Recognition

Automatically classifies W-2, 1040, 1065, paystubs, bank statements, corporate returns, and multi-entity packages.

OCR + Intelligent Data Extraction

Key data points are extracted from every document instantly — even across multi-business tax returns.

Zero Manual Sorting

Documents are auto-organized and tagged the moment they're uploaded.

Complete Visibility & Seamless Communication — For Everyone

Borrowers, loan officers, and processors get a single, real-time view of the loan file with smart checklists, progress tracking, expiration alerts, and unified messaging—all in one dashboard.

Live Progress Bar

Borrowers see exactly where they are in the process.

Missing Document Tracker

Profile-based smart checklist that updates automatically as documents are submitted.

Expiration/Past Due Alerts

Automatic notifications before documents expire, so nothing holds up the file.

Unified Messaging & Automated Follow-Ups

Every conversation and update are stored in a single unified communication hub and intelligent follow-ups.

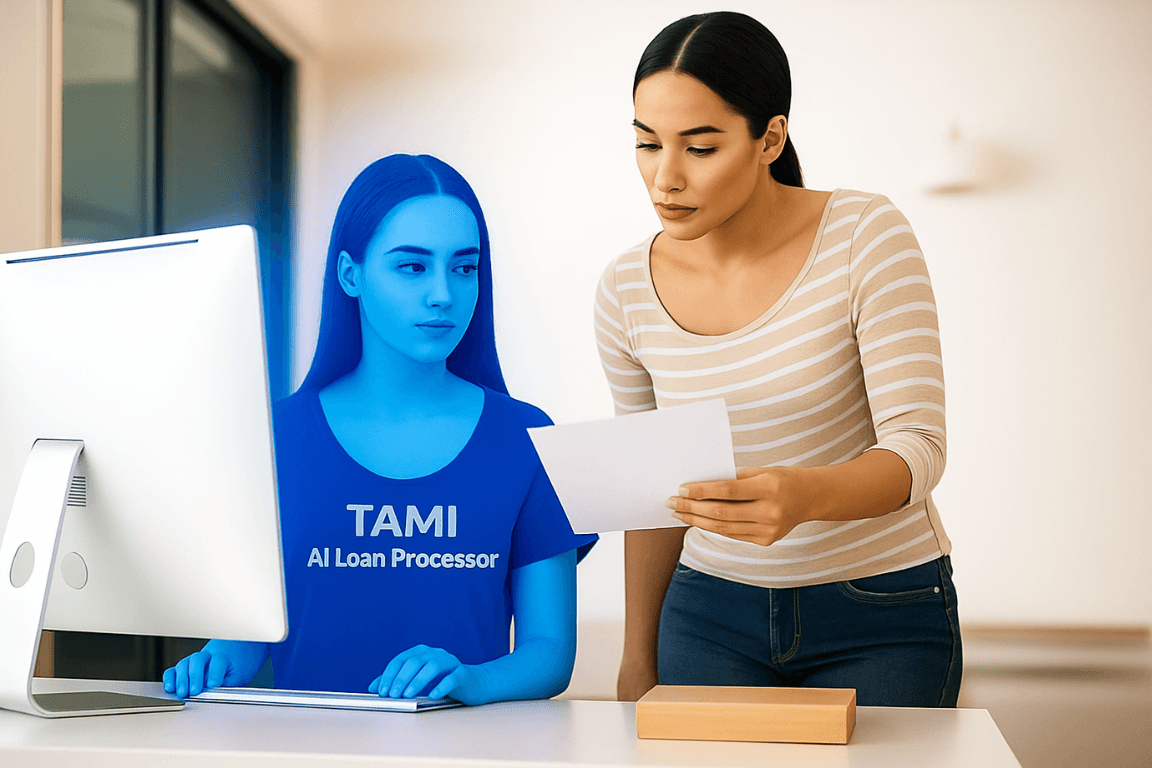

TAMILoan Processor

TAMILoan Processor

Intelligent document processing that transforms every file into fast, accurate decisions — delivering AI-driven loan processing with full GSE compliance, unmatched cost efficiency, and turn times in days, not weeks.

See TAMI-Processor In Action

Experience real-time intelligent automation across every mortgage workflow

Intelligent Document Processing

Automate Document Review

Upload any loan document and watch TAMI extract, verify, and analyze income, assets, debts, identity, legal, and property data—instantly.

Auto-Classification

Recognizes financial, legal, identity, business, and property documents (including appraisals).

Risk Highlighting

Flags compliance issues, inconsistencies, missing info, and appraisal red flags.

Zero Manual Entry

Eliminates hand-keying and saves hours per loan.

Income, Asset & Debt Extraction

Auto-captures balances, liabilities, DTI, reserves, and cash-flow from tax returns, paystubs, bank statements, and credit reports.

KYC & Identity Verification

Extracts IDs, passports, SSN cards, and more.

Immigration & Legal Docs

Reads visas, EADs, I-94s, divorce decrees, child-support/alimony orders, etc.

Appraisal Intelligence

Extracts key property data, comps, adjustments, and risk signals directly from appraisal reports.

And Much More…

AI Income Intelligence

Automated analysis for every income type—from simple W-2 earnings to complex multi-entity business returns—powered by real-time, GSE-compliant cash-flow calculations.

All Income Types Supported

Salary, hourly, commission, bonus, overtime, rental, retirement, alimony, child support—every income stream calculated automatically.

All Business Entities Covered

C-Corp, S-Corp, LLC, Sole Prop, Partnerships—full automation of 1120, 1120S, 1065, Schedule C, K-1s, P&L, Balance Sheets, and passthrough cash-flow analysis.

Automated Cash-Flow Intelligence

Multi-year trend analysis, anomaly detection, add-backs, expense adjustments, liquidity insights, and business cash-flow evaluation.

GSE Compliant

Instant guideline-mapped calculations with real-time eligibility and consistency checks.

Live Compliance, Risk & Pipeline Intelligence

Stay ahead of risk with real-time monitoring across your entire loan pipeline. TAMI provides instant alerts for compliance issues, credit risks, missing documents, and required actions—before they become bottlenecks.

24/7 Automated Monitoring

Continuous, intelligent risk assessment on every loan from intake to closing.

Instant Compliance & Credit Alerts

Proactive notifications for guideline issues, discrepancies, and emerging credit concerns.

Dynamic Eligibility Insights

Real-time qualification updates as documents are uploaded and borrower data changes.

Integrations

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

Built For Forward Thinking Lending institutions

Empowering Mortgage Brokers, Credit Unions, Local Banks, and Underwriters to transform loan processing with AI

Mortgage Brokers

Close deals faster with automated processing and instant updates.

Credit Unions

Enhance member experience with real-time tracking and personalized service.

Local Banks

Compete with enterprise-grade AI while keeping your personal touch.

Underwriters

Make faster decisions with AI-powered risk assessment and compliance.

Trusted by Industry Experts

Social proof from lending innovators who scaled faster with TAMI.

Move from Manual Work to Intelligent Automation

Give your borrowers a delightful experience — and your team superpowers.